- Home

-

Private banking

-

LGT career

Adam Smith (1723-1790) was a key figure in the Scottish Enlightenment, whose work laid the foundations for modern economic thinking. How can we interpret his legacy in the context of modern markets?

Smith's best-known work, "The Wealth of Nations" (1776), was published during the first Industrial Revolution and the same year as the American Declaration of Independence, sharing key themes of innovation and self-determination.

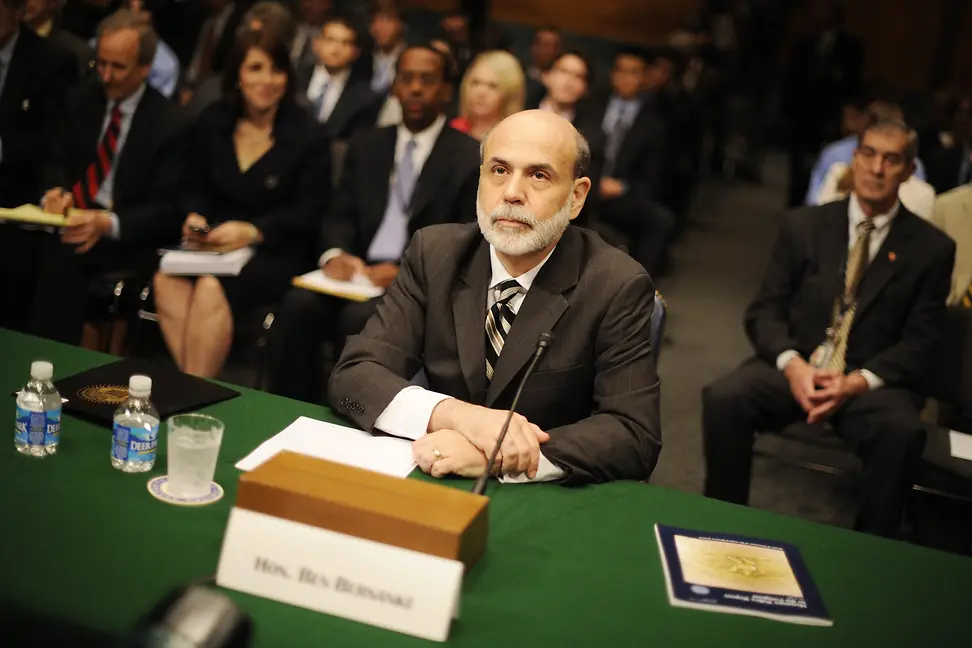

It laid the foundations for modern economic thinking and has been cited as a key influence by major economic and political figures from the 20th century onwards, from Nobel Laureates to Federal Reserve Chairs, Presidents to Prime Ministers.

Smith's concept of the "invisible hand", which we detail in this article, helps frame the tension between free market forces and regulatory oversight. Over the centuries, his work has been evaluated against major economic events, with supporters and critics alike referencing his ideas to justify both laissez-faire policies and interventionist approaches - but how can we interpret his legacy in the context of modern markets?

Smith coined the metaphor "an invisible hand" to describe how selfish acts can still drive wider societal benefits.

It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their self-love, and never talk to them of our own necessities but of their advantages

Smith postulated that self-interested trading in truly free markets should lead to an efficient and self-regulated market, without the need for governmental intervention. The baker, for example, bakes bread to make a living; however, in order to succeed, they must sell it at a fair price, otherwise their customers will shop elsewhere. Even though the baker's goal is profit, the outcome is that the customer has affordable bread.

In essence, "the invisible hand" speaks to the idea that when individuals pursue their own interests for personal gain in a competitive market, they frequently contribute to society's wellbeing as a whole - even if this is unintended. The concept that markets tend toward this optimal equilibrium, without intervention or steering, became a cornerstone of free-market capitalism and the core assumption of neoliberal economics.

Proponents such as President Ronald Reagan and Prime Minister Margaret Thatcher helped later shape the idea of society as a living market, where competitive pressures lead to innovation, and supply and demand ascribe everything a fair value.

Hailing from the same Scottish town of Kirkcaldy, Fife and even attending the same school, former PM Gordon Brown made no secret of his deep admiration for Smith. However, in response to the Global Financial Crisis (GFC, 2008) and faced with the prospect of economic collapse during his tenure, he pushed for unprecedented intervention. These included bank bailouts, coordinated international policy efforts, bringing interest rates to near-zero and, eventually, large-scale quantitative easing (QE).

While QE provided immediate stability during a period of acute uncertainty, its long-term impact on markets and economies remains widely debated. Some highlight its effectiveness in averting deeper recession and restoring confidence, while others point to inadvertent challenges such as prolonged market reliance on central banks and the contribution to subsequent inflation.

Had he been witness to the last two decades, Smith might point to how well-intended intervention can lead to a prolonged, and sometimes painful, series of unintended consequences - perhaps the effect of the "visible hand". He might argue that interventions set precedents, and only lead to further interventions.

On the other hand, critics argue that the GFC exposed the limitations of Smith's "invisible hand". That without oversight and intervention, the results on wider society would have been catastrophic. That better oversight and innovation might have avoided the crisis in the first place. The ongoing debate highlights the nuanced and evolving nature of market intervention, and the continuous balancing act between supporting organic market behaviour and maintaining financial stability.

Much of the criticism levelled at Smith is at the version of his philosophies popularised in the 20th century. Notably, American Nobel economics prize winner Paul Samuelson (1915-2009), adviser to Presidents John F. Kennedy and Lyndon B. Johnson, refined and narrowed the definition of "the invisible hand" that underpins Neoliberal thinking. Samuelson's interpretation, however, largely stripped the moral dimension from Smith's reflections.

Smith was as much a moral philosopher as an economist and did not separate the two. His earlier work "The Theory of Moral Sentiments" (1759), considers how human morality depends on sympathy between the "agent" and "spectator", or put simply, the individual and other members of society. In "The Wealth of Nations", he qualified "the invisible hand" as only working properly when constrained by moral norms and justice. By modern standards, Smith was no free-market purist.

While he did not use the modern term "stewardship", Smith's writings touch on the responsibility individuals and institutions have when allocating capital. This is echoed today, in the United Nations backed Principles for Responsible Investment (PRI).

The PRI initiative began in early 2005, when then-UN Secretary General Kofi Annan invited a group of the world's largest institutional investors to incorporate environmental, social and governance (ESG) factors into their investment decisions. Launched in April 2006 with 100 founding signatories, LGT was an early signatory in 2008 and has an ongoing active role, with a Managing Partner serving on the PRI's board of directors since 2018.

ESG investing recognises that long-term value is closely linked to positive societal and environmental outcomes. Investors who prioritise ESG factors may avoid allocating capital to businesses with a negative societal impact, or they may engage with management to drive meaningful improvements - an evolution of Smith's belief in the interconnectedness of economic and moral progress.

At LGT, we see stewardship as a core responsibility, central to how we manage capital on behalf of our clients and society. We believe profit-seeking should be aligned with positive societal impacts, and poor practices should be highlighted. By leveraging tools such as proxy voting and direct company engagement, we seek to promote sustainable business practices and encourage positive change for the benefit of clients and wider society.

The definition of "value" goes beyond monetary alone, and in today's world sustainable and ethical practices are increasingly rewarded by markets and investors alike. Perhaps the spirit of Smith's "invisible hand" is best realised when self-interest aligns with the long-term wellbeing of society as a whole.

LGT uses the definition "Stewardship is the responsible allocation, management and oversight of capital to create long-term value for clients and beneficiaries leading to sustainable benefits for the economy, the environment and society, on which returns, and client and beneficiary interests, depend." This is based on the UK Stewardship Code (2020) and the definition of the Principles for Responsible Investment (PRI), the world's leading proponent of responsible investment.