- Home

-

Private banking

-

LGT career

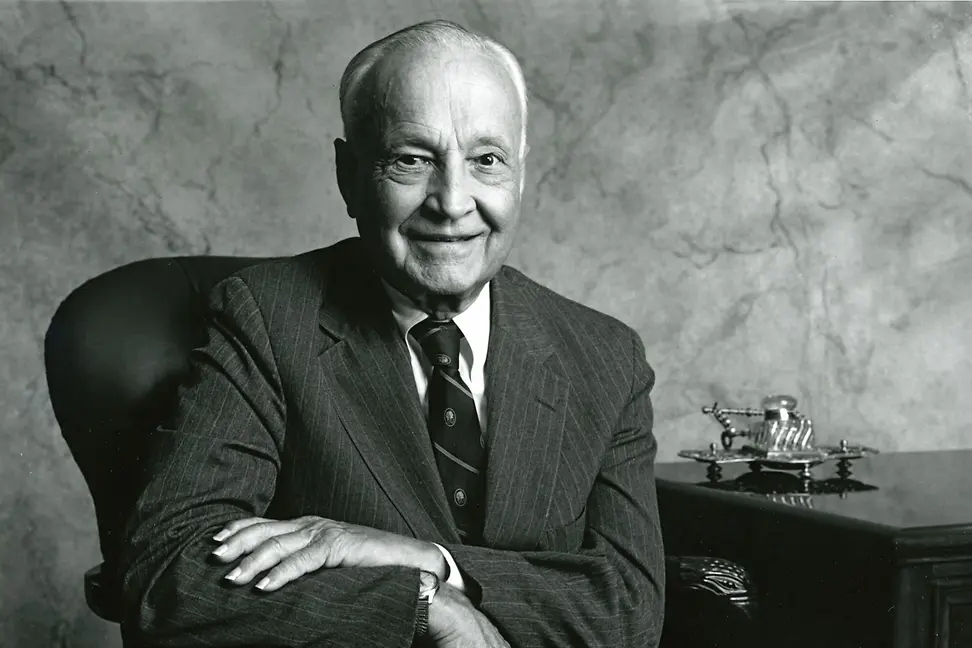

Renowned for his skill as a stock picker, the great contrarian was also a committed Christian whose convictions inspired the philanthropy for which he is equally famous.

For John Templeton, a lifelong Presbyterian who made a fortune pioneering globally diversified mutual funds, faith and finance were closely intertwined.

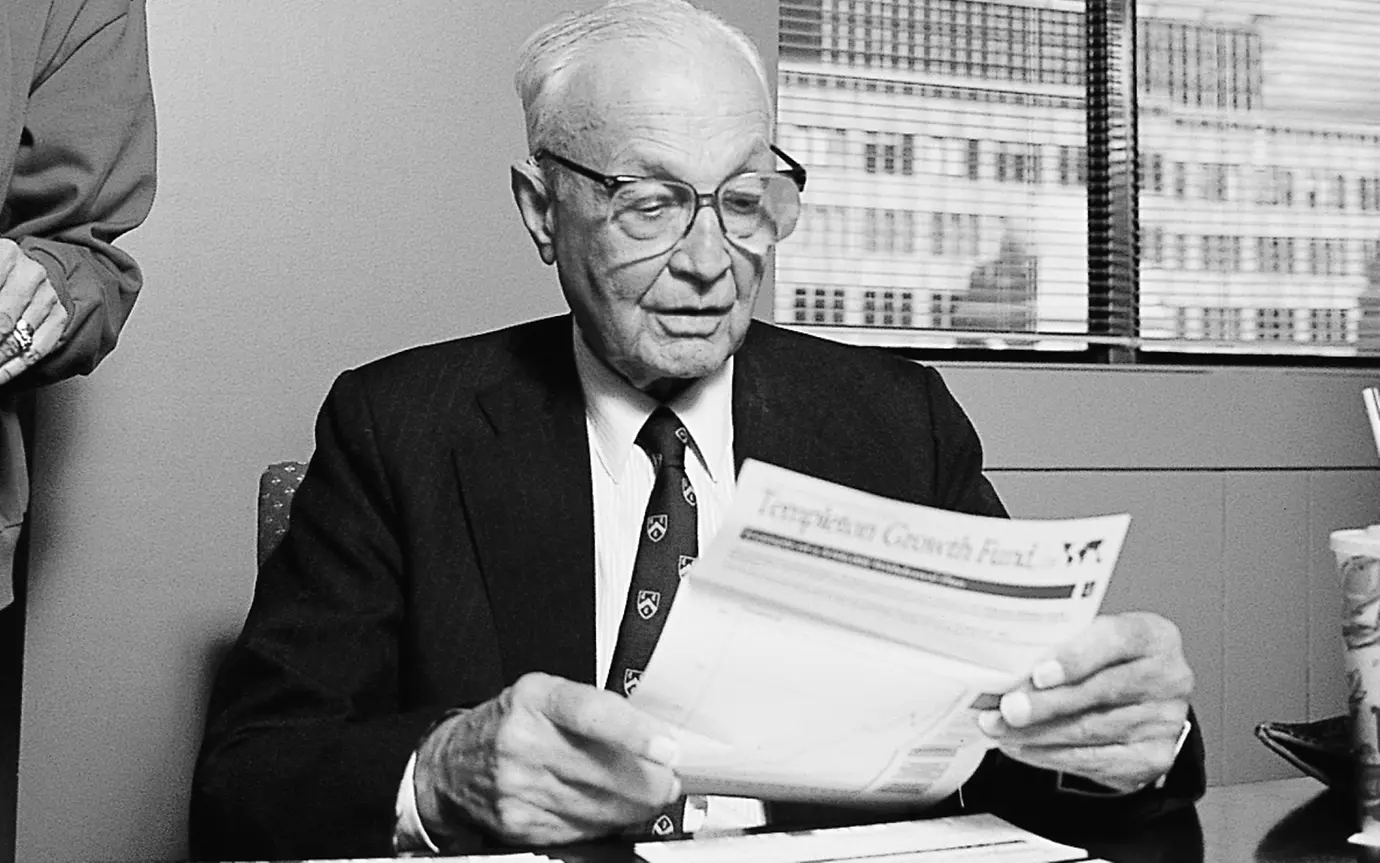

His legendary Templeton Growth Fund averaged annual growth of more than 15 % over nearly 40 years, helping to make him a billionaire. And he used much of his wealth to establish a 3.4 billion USD foundation dedicated to the proposition that scientific inquiry can bring us closer to God.

To some, of course, that smacks of pseudoscience. But Templeton considered science and religion to be complementary.

His overall purpose, he said, was to encourage people to be more open-minded. "What I'm financing is humility," he told Business Week in a 2005 interview. "I want people to realize that you shouldn't think you know it all."

Humility's role in Templeton's financial success is debatable, although he was famously frugal. "He believes it's OK to make money so long as you don't enjoy it," a friend once joked.

But Templeton himself attributed much of his worldly success to his ability to maintain a level head, avoid anxiety, and stay disciplined. His first-class intellect was plainly also an advantage.

Born in 1912 in Winchester, Tennessee, John Marks Templeton graduated in economics from Yale University near the top of his class in 1934. He was a Rhodes Scholar at Balliol College, Oxford, where he studied law, before launching his investment career in 1937.

With US markets still reeling from the Great Depression, it wasn't a good time to arrive on Wall Street. But right from the start, Templeton took an unconventional approach to investing.

In 1939, he borrowed money to buy 100 shares in each of 104 companies that were selling at one dollar per share or less, including 34 in bankruptcy. Sure enough, as US industry geared up for war, most of these companies' fortunes turned. Only four of Templeton's picks turned out to be worthless, and he made substantial profits on the rest.

"Arguably the greatest global stock picker of the [20th] century," according to Money magazine, Templeton's stock-selection strategies defy easy categorisation - but his mantra was clearly: buy low, sell high.

However, Templeton never bought stocks merely because they were undervalued. He avoided those he considered expensive, defined as an estimated five-year forward P/E ratio higher than about 12 to 14. The companies he invested in had to have good long-term potential, according to the fundamental analysis he favoured. He held them on average for about four years.

In many ways, indeed, Templeton was a classic value investor, much like Warren Buffett and their mutual mentor, Benjamin Graham. As a result, while he did better than the market average in crashes and bear markets, his returns during bull markets tended to be disappointing.

His flagship Templeton Growth Fund Ltd. was nevertheless astonishingly successful. It was also among the first US investment funds to adopt a global outlook.

Originally incorporated in 1954 in Canada, which levied no capital gains tax at the time, the fund sought investment opportunities in then-overlooked foreign markets, notably Japan.

In fact, Templeton was such an early investor in Japan that he struggled to find bilingual stockbrokers to handle his firm's trades. True to his core philosophy, however, he rotated out of Japanese stocks in the 1970s when they became more fashionable (and expensive), and turned instead to US stocks, which were then at historic lows.

Templeton also created funds to invest in specific industries. In 1956, for example, he partnered with marketing consultant William Damroth to launch the Nucleonics, Chemistry and Electronics Fund, a specialty fund that reflected his interest in science and technology.

By 1992, when Templeton sold his combined funds to the Franklin Group for 440 million USD, their assets under management had swelled to 22 billion USD.

By then, Templeton had moved into the second and significantly more spiritual half of his long life.

Having renounced his US citizenship in 1964, some said for tax reasons, although he always denied this, Templeton had become a dual Bahamian-British national, and was resident in Nassau, Bahamas, from where he launched numerous philanthropic initiatives, usually with a religious dimension.

In 1972, for example, he established the Templeton Prize for Progress in Religion, whose first recipient was Mother Teresa of Calcutta. The size of the prize, now simply called the Templeton Prize and currently worth 1.6 million USD, dwarfs that of the Nobel Prizes, underscoring Templeton's belief that "advances in the spiritual domain are no less important than those in other areas of human endeavour."

The Templeton Religion Trust, founded in 1984, was the first of three charitable organisations established to promote a similar message. The others are the Templeton World Charity Foundation, and the John Templeton Foundation, which was established in 1987, and is probably the best known of all his eponymous entities.

Templeton's convictions attracted numerous admirers, among them former UK prime minister, Margaret Thatcher. Her government knighted Templeton for his philanthropy in 1987, after which he became known as Sir John. Meanwhile, Oxford University's Templeton College, an internationally oriented graduate college now called Green Templeton College, which he endowed in 1983, testifies to his belief in educational inclusivity.

But Templeton never abandoned his interest in finance and the markets. To the contrary. In 2005 he wrote an extraordinarily prescient memorandum, which was initially privately circulated to family and close associates, but only made public in 2010, two years after his death at the age of 95.

The memo foresaw global financial chaos within the next five years, anticipating both the collapse of the housing market and the dramatic decline in government bond yields. Templeton also predicted that traditional schooling would eventually be eclipsed by "electronics", what we'd now understand as internet-based learning, and foresaw increasing prosperity for the richest 1 % of society.

While not all Templeton's predictions have come true (yet), his two key convictions have stood the test of time: value investing as a route to prosperity, and the use of philanthropy to promote his ideas on scientific discovery, spirituality, and human flourishing around the globe.