- Home

-

Private banking

-

LGT career

Classic cars can bring joy, prestige - and only rarely a return on investment. The decisive factors are the history, technology and rarity under the bonnet.

In these times of negative interest rates, investors have a lot to think about. Is the price of gold really going to continue to rise? Do I really want to have a Jean-Michel Basquiat hanging on my wall as an investment? Surely, an elegant classic car would be more fun. And not only that: I see it all the time, good cars are worth their weight in gold. Their prices keep going up - and they offer the perfect combination of fun and returns.

If it were only as simple as that.

Before delving into the subject of when a classic car is considered a collector's item and when it is an investment object, we should first try to define what constitutes blue-chip cars. What differentiates them from the vehicles that will eventually be scrapped?

The clearest way to explain this hard-to-define quality is to establish a few parameters:

Was the car made by a manufacturer with a long-standing history? Names such as Mercedes-Benz, Bugatti, Porsche, Ferrari or Bentley would indicate yes.

Has the model written technological history? Has it helped with the breakthrough of certain technologies or led to the introduction of new materials?

Another benefit is if the car has participated successfully in races or rallies.

Those who are interested in Concours competitions are never disappointed in terms of design icons - aesthetics count for more than sheer performance at these events.

And last, but not least, remains the question of quantity - the smaller the number of units manufactured for a certain model, the better.

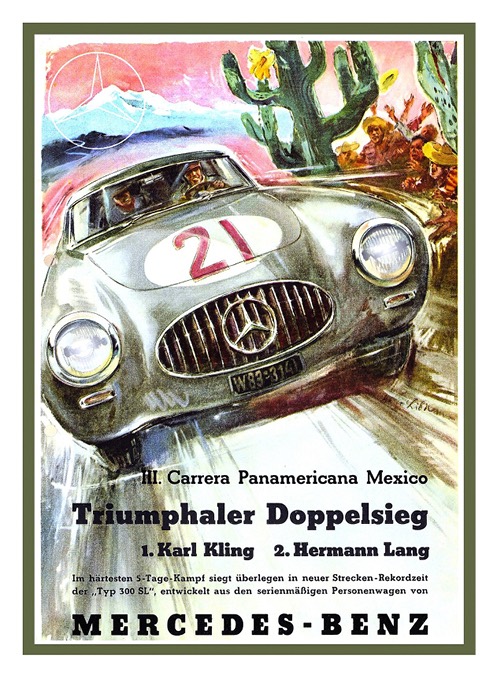

Let's apply these five parameters to two or three models - starting with the Mercedes-Benz 300 SL Coupe, which was built in series production starting in 1955. The "Gullwing" was made by the oldest car manufacturer in the world and with its mix of aggressive features (gullwing doors!); avant-garde technology (tubular frame/first fuel-injected series-produced car), a successful sporting career (four victories in five races in 1952 - including the 24 Hours of Le Mans and the Carrera Panamericana) and only 1400 units built, it is a perfect example of a car that will never again be cheap to buy.

However, the 1400 Coupes - and 1858 300 SL Roadsters that came onto the market later - result in a relatively high number of cars manufactured, and prices have levelled off accordingly at around one million euro (Roadster) and 1.3 million euro (Coupe).

If we look at today's most expensive vehicle - and leave out museum pieces that are not for sale, such as the 300 SLR with which Stirling Moss won the Mille Miglia in 1955 - then our next model is the Ferrari 250 GTO. This aggressively shaped vehicle won the Constructor's Championship from 1962 to 1964 and raced to hundreds of victories. What's more, only 36 units were built during those three years, meaning that Ferraristis with deep pockets now pay up to 80 million dollars for such a model.

Having said that, the chance of finding a Ferrari 250 GTO at that price is unlikely, because they are owned by billionaires who don’t want money, they want a 250 GTO. So let's now take a look at the Jaguar E-Type: great design, great manufacturer - but no extravagant technology, hardly any racing successes and a whopping 72,535 models built. This makes the E-Type a wonderful car to own and drive, but investors shouldn't expect to make money with it.

Which would appear to answer the question of whether automobiles can be worth their weight in gold: anybody who - like Pink Floyd drummer Nick Mason - bought their 250 GTO for GBP 72 000 at the end of the 1970s, undoubtedly tapped into the holy grail of money-making. And when Ralph Lauren purchased one of the three Bugatti Type 57 SC Atlantic cars built in 1988, he probably had no idea that the car would one day be worth USD 50 million - or even more?

Nick Mason from Pink Floyd was lucky: "I bought my 250 GTO in 1978 for GBP 72 000 - an unbelievable amount of money for a used Ferrari back then. I bought it because I wanted it - I never thought about the possibility that it could increase in value."

The takeaway here is that nowadays, you can only make a lot of money with a car that already costs a lot of money when you buy it - any tips to buy a Porsche 911, a Corvette or an Austin-Healey 3000 as a way to earn money are worth less than the ink used to print the ads they are contained in.

The essential question is: what does the owner plan to do with their acquisition? Participate with it at a Concours? Then it should be a rare vehicle with a notable body and preferably some interesting previous owners - but be careful: the criteria for being admitted to the Concorso d'Eléganza Villa d'Este set a very high bar and are accordingly expensive meet.

If the car is simply to be used for a few nice trips a year, then a vehicle with tried-and-tested technology and a secure supply of spare parts is recommended. Anyone looking for adventure on race or rally tracks has completely different needs and should first join corresponding teams to "experience" whether their money is well invested here.

Let us return to the five cornerstones:

Cars that meet all these criteria come with a price tag. And it is important to know that the purchase price is not the only factor to consider, because this kind of acquisition is tied to a considerable amount of follow-up costs. The condition of the car must be maintained or - if weaknesses are identified - improved. Cars have to be driven, otherwise damages will ensue. All of these factors translate into regular expenses for maintenance, conservation, garage rental and insurance. These costs should be carried by the increase in the car's value - and are not carried in the case of vehicles manufactured in large numbers, such as a Porsche 911, a Pagoda, a VW Beetle cabriolet or an Alfa-Romeo Spider. These are delightful hobby cars that result in the loss of very little money if an honest calculation is made.

So the rule is to look for distinct models of established companies that were manufactured in limited numbers - anyone who parked a Group B car, which were limited to a production number of 200, in their garage twenty years ago, did well. Brands such as Porsche, Ferrari and Aston Martin have implemented this insight in the form of limited editions which - if you have enough financial clout to buy one - can increase in value within a few years. And so the same applies here: always buy the best that you can afford.

However, there is another way to invest in a car that will increase in value, a way that entails virtually no risk: go to one of the cult automobile brands or, for example, to the Carrozzeria Zagato or Touring Superleggera, and commission a custom-made car. Manufacturers such as Aston Martin, Ferrari, Lamborghini, Rolls-Royce and Bentley are happy to offer this admittedly expensive possibility, because these unique specimens bring fame and honor to both the manufacturer and its proud owner - and always attract buyers.

Is there such a thing as a car that is worth its weight in gold? The answer is yes, if you are willing to invest a lot of money and have knowledgeable advisors. For most of us, however, collector cars are fun vehicles to be used to enjoy good times. In this case, the search for returns should not be the main focus.

LGT’s experts are always busy analyzing global economic and market trends. Our research publications on the international financial markets, sectors and companies will help you make informed investment decisions.