- Home

-

Private banking

-

LGT career

Prices for NFTs have soared. How safe is it to invest in NFTs? May the bubble be close to bursting?

If the catchword for NFTs in 2021 was FOMO (fear of missing out), then 2022 is shaping up to look more like BAYP: buy at your peril.

Unless you have been living under a rock for the past 12 months, you’ve probably heard about the non-fungible tokens craze. The much talked about yet little understood phenomenon catapulted from obscurity to an overnight sensation after American Artist Mike Winkelman, better known as Beeple, sold an NFT of digital collage of 5,000 photographs for $66 million at a Christie’s auction house in March last year.

In no time celebrities, entertainers and athletes were jumping on the bandwagon. NFL quarterback Tom Brady, US Olympic gymnast Simone Biles and Tiger Woods created NFT video clips of their greatest sporting moments. TV talk show host Jimmy Fallon, Paris Hilton and Justin Bieber bragged about their NFT purchases. Twitter founder Jack Dorsey sold an NFT of the first ever tweet.

According to crypto research consultancy Chainalysis, the market for NFTs soared to $44.2 billion last year, up from $106 million in 2020. While Millennial gamers and crypto millionaires with fat wallets were the first to the party, high-net- worth collectors weren’t far behind. Of 2,339 HNWs surveyed for the 2022 Art Basel and UBS Global Art Market Report, some 74% had bought art-based NFTs in 2021 and 88% said they are interested in buying NFT-based artworks in the future.

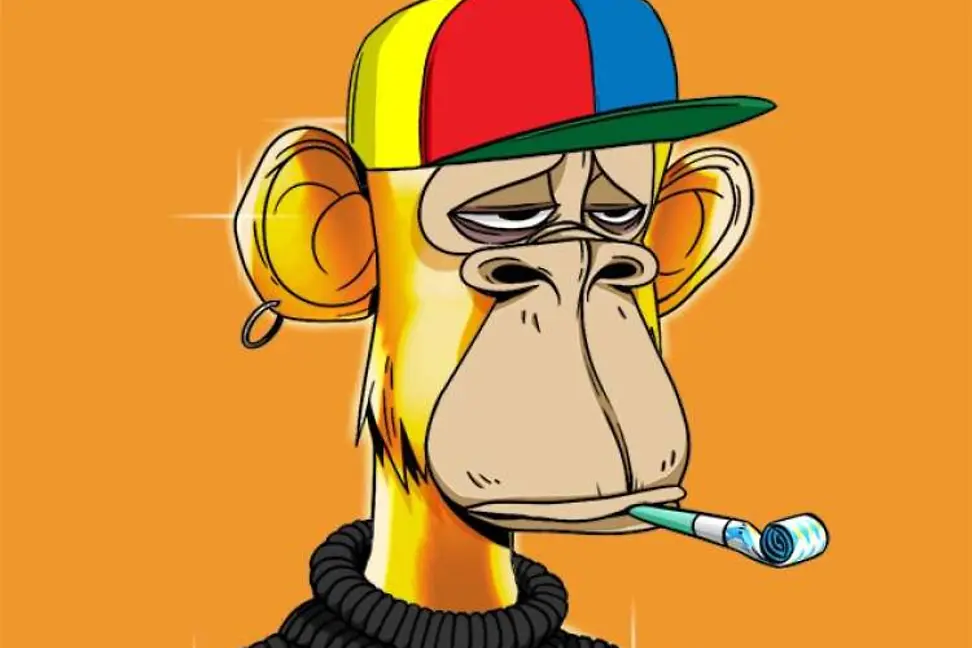

Nothing better illustrates the NFT craze than the Bored Ape Yacht Club, or BAYC phenomenon. The collection consists of 10,000 computer-generated NFTs featuring cartoons of blasé simians in various costumes and colours, Some shoot lasers from their eyes. Some sport heart-shaped sunglasses or bunny ears. Some are decked as vintage fighter pilots, punks with piercings and even gender bending prom queens.

When they were initially minted in April 2021, they cost just 0.08 Ethereum, about USD 192 at the time. A year later, the cheapest BAYC NFT sells on the trading platform OpenSea for about USD 290,000 - more than ten times the average price of USD 25,730 of all art works sold at auction in 2021, according to the Artprice 2021 Global Art Market Report released in March. In October, a Bored Ape sold at Sotheby’s for a record USD 3.4 million. A major factor driving their popularity was their use as avatars in social media and in the metaverse.

"It’s pure speculation and most of what we see in the current structure (of cryptocurrencies) is nonsense on stilts and NFTs just typify that", says Michael Every, an economist and strategist in Singapore at Robobank, who does not cover this market. “When people stay at home and day trade, apes wearing sunglasses are essentially a lottery ticket.”

Art insiders also say the speculative fever is creating an untenable situation. “It’s a house of cards,” says Edie Hu, former art advisor at Citi Private Bank who now runs Centerpiece Art Advisory in Hong Kong.

She points out the astronomical sums paid for jpegs of a cartoon that anyone can download on the internet for free is pure madness. “Anyone who pays that much really needs to get their head examined. Even an extremely rare original Walt Disney hand-drawn Mickey Mouse “sel” from 1935 recently sold for only USD 85,000. I’d rather have that than some bored ape,” she said.

The primate craze has spawned all sorts of clones. There’s Desperate ApeWives and Bored Ape Yacht Club Clones. The most audacious rip-off called PHAYC (with the tongue-in-cheek tagline “Phayc it til you make it) created a collection 10,000 NFTs by flipping the original BAYC avatars to face left instead of right. Their prices plummeted after getting kicked off most major trading platforms when BAYC creator Yuga labs complained of copyright infringement.

Though buying an NFT minted on the blockchain guarantees ownership, it does not ensure authenticity. In February, popular trading platform OpenSea said it had removed 1,138 NFTs after artists including Damien Hirst and Anish Kapoor complained that the digital tokens had been linked to their physical works without their permission. Both Nike and Hermes have taken legal action against people who created unauthorized NFTs using their trademarks.

Trademark and intellectual property owners (and unwitting buyers of authorized NFTS) are gradually getting the same protections from digital infringements as they do in the physical realm. “Initially, trading platforms took no responsibility, but in e-commerce, the more astute and long-term thinking platforms are responding to take down notices”, say Padraig Walsh, a partner at Tanner De Witt law firm specializing in Technolog, Media and Telecommunications (TMT) in Hong Kong. "We must see more of that going forward for this space to have legs."

Phishing and hacking also pose real risks in a market that is virtually unregulated. New York-based gallery owner Todd Kramer who tweeted on December 31 he had been duped out of USD 2.2 million worth of NFTs in a phishing scam that accessed his digital wallet.

Two months later an NFT collector named Larry Lawliet tweeted he lost an estimated USD 2.7 million worth of digital tokens after one of the servers operated by the popular social media network Discord for traders of NFTs was hacked. In January, OpenSea discovered that 80 percent of NFTs minted on its free platform were fake or stolen.

Another popular scam is wash trading. This is done using several crypto wallets belonging to the same owner who essentially buys and sells between them to manipulate prices and create the illusion of liquidity.

In the first reported crackdown by law enforcement, the U.S. Justice Department charged two men in March this year with fraud and money laundering USD 1.1 million in cryptocurrency connected to a collection of NFTs called Frosties. After promising buyers tokens, rewards and giveaways (which should have been red flags for investors) as well as privileged access to a game on the Metaverse, the two siphoned most of the money to different cryptocurrency wallets.

Though buying an NFT minted on the blockchain guarantees ownership, it doesn’t necessarily ensure authenticity.

In another thinly veiled digital knockoff, the developer of a set of 10,000 NFTs called Evolved Apes, raised USD 2.7 million, largely on the promise that the simian avatars would give buyers access to a game where the apes fight for survival. Two weeks later, in a classic “rug pull,” the developers closed their twitter account and website, leaving investors in the lurch

There are of course many legitimate artists creating NFTs, but collectors should exercise caution, do their own research and only invest as much as they are prepared to lose.

Luckily there are plenty of resources to help you do your homework. There are dozens of websites providing data and background on NFT trading including EtherScan.io, NonFungible.com, and Coindesk.com. The top three NFT marketplaces, OpenSea, Rarible and Nifty Gateway provide comprehensive real-time trading data for free. Most importantly, learn as much as you can about the developer or creator – no small challenge as so many people who mint NFTs don’t reveal their true identity.

Also be careful about what information you disclose on social media. Popular social media chat rooms like Discord and Clubhouse are also an excellent way to keep up to date on developers. But they are not secure, and highly susceptible to attacks by bad actors and scammers looking to access your digital wallet.

There are some less risky options, more modest blue chip NFTs available. The British Museum has minted NFTs of digital versions of watercolours by J.M.W. Turner and the 17th Japanese woodcut of Hokusai’s “Wave”; the Uffizi gallery created an NFT of Raphael’s “Madonna of the Goldfinch” and Vienna’s Belvedere Palace Museum turned Gustave Klimt’s iconic “The Kiss” into a digital grid consisting of 10,000 unique NFTs were offered at 1,850 Euros apiece on Valentine’s Day.

If you are thinking of investing in NFTs, bear in mind you already late to the party in what is a volatile market.

For further proof that the bubble may be close to bursting, look no further than Jack Dorsey’s NFT. When he first minted it in March 2021 it sold for USD 2.9 million. When the buyer tried to resell it on in April with an asking price of USD 48 million, the highest bid came in at just USD 277.

“The market has gotten off to a whirlwind start especially since traditional houses like Christies’s and Sotheby’s have gotten in on the act, says Mischel Gallo, Head Market Risk Management at LGT Private Bank. "Just as in other markets, once the PFP NFTs (the use of NFT-generated avatars as profile pictures on social media) and prices normalize, the same will happen here. But I think purely NFT-based artworks could be a trend in the future."

As the prices of cryptocurrencies began their stomach-turning lurches down in June, Microsoft co-founder Bill Gates added another word of caution. Those digital asset trends are ‘100 percent based on the greater fool theory’ he said at a TechCrunch conference on June 14, where investors can make money on dubious or overvalued assets as long as there are newcomers willing to bid them higher.

Sascha Pallenberg, tech blogger and chief awareness officer at aware, shares Gate’s sentiments. “While I am not against NFTs in general, 99.9 percent of it is a scam. I mean…let’s, these artworks are not only insanely boring but also quite ugly. This about finding another fool you can sell this digital asset to.”

Nevertheless, the market is bound endure, he says. "Do believe we will see a correction? Yes, but will it stop scammers from promoting the next big NFT collection? No! People are greedy and this will keep this Ponzi scheme alive."