在此处更改您的语言和 LGT 位置。

私人客戶的數碼平台

登錄 LGT SmartBanking

金融中介機構的數碼平台

登錄 LGT SmartBanking Pro

解答常見問題 (FAQ)

LGT SmartBanking 幫助

解答常見問題 (FAQ)

LGT SmartBanking Pro 幫助

Investing in oil has always been a venture. It started as a gold rush, then turned into a losing game.

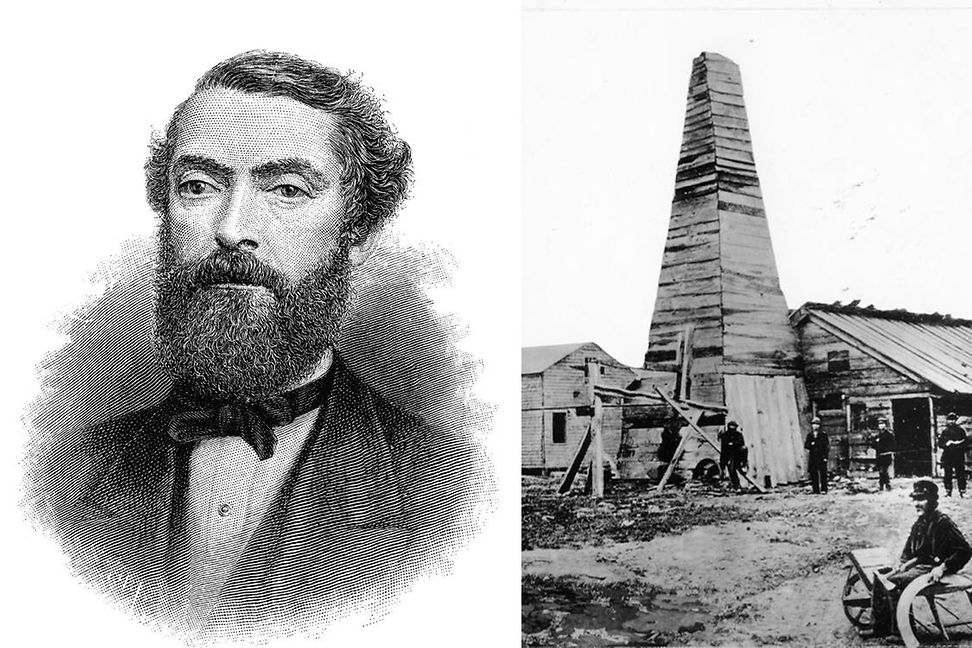

In the late 1850s, a crowd gathered to jeer at Edwin Drake. The former train conductor and businessman was experimenting with a giant drill that bore downwards into rock near his home in Titusville, Pennsylvania. A steam engine powered the drill, which Drake had modelled on methods then used to extract brine for making salt.

For months, the drill strained against the rock, making painful progress and bemusing locals. Drake began to run out of money. Then, one summer day in 1859, at a depth of more than 20 metres, the drill hit a crevice. The next morning, crude oil began to rise up the pipe through which Drake had drilled. The astonished men collected the oil in a bathtub.

That bathtub contained black gold. Within weeks a rush was on to drill for oil across the state and beyond. After coal had powered the industrial revolution, oil was about to fuel a new global economy - and define modern life.

Until then, oil had been collected from the surface of rock or extracted from whale blubber - both inefficient and costly processes (not least if you were a whale). Oil was mainly used for lamps. It was not viewed as especially valuable, much less a commodity worth investing in.

When Drake struck gold, skepticism lifted and word spread around the US. Now that oil could be efficiently extracted in gushing quantities, it began to look a lot more appealing to would-be barons.

One of the men who took an interest in the boom of the early 1860s was a young entrepreneur called John D. Rockefeller. The son of a travelling salesman had trained as an accountant but saw potential in oil. He built a refinery in Ohio in 1863 and sold lamp oil, lubricants, petroleum jelly and tar for paving.

Rockefeller had a laser focus on efficiency. He borrowed heavily and reinvested profits, while taking advantage of the explosion in railways and prosperity after the US Civil War. By 1870, he had co-founded Standard Oil. It became the world’s biggest company. In relative terms, Rockefeller remains the world’s richest man.

Yet in 1878, the vagaries of the oil markets revealed themselves for the first time. The invention of the electric light bulb quickly made kerosene all but obsolete. Oil demand slumped. A fraught cycle of boom and bust was established that would continue to this day.

Rescue came on four wheels when, in 1903, Henry Ford launched the age of the motor car. Gasoline, until then a drilling byproduct, transformed the oil industry; a process that took off again with the advent of aviation. The demands of World War One fueled yet more growth. Fearing a shortage of oil, the US government encouraged exploration and buyouts abroad, including in the Middle East.

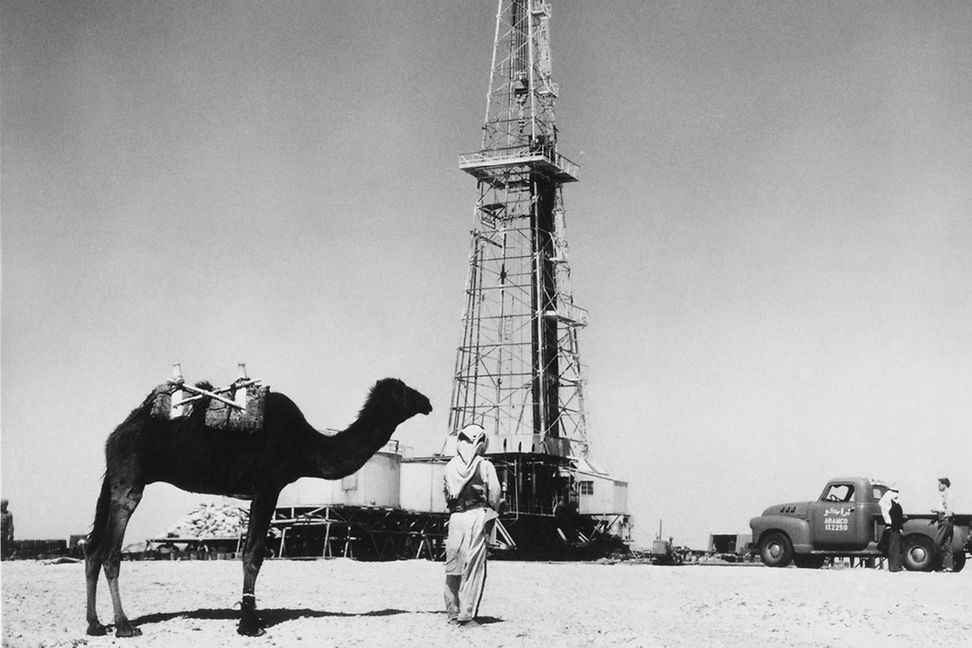

The Great Depression caused oil prices to collapse. Thousands of miles away from Wall Street, it also caused a crash in the number of pilgrims in Saudi Arabia, the tax on whom had been the main income for Ibn Saud, the country’s founding king. Once skeptical of his kingdom’s oil producing potential, he decided to commit to extraction. By the end of the 1930s, Saudi Arabia was the world’s largest source of crude oil.

The Great Depression caused oil prices to collapse. Thousands of miles away from Wall Street, it also caused a crash in the number of pilgrims in Saudi Arabia, the tax on whom had been the main income for Ibn Saud, the country’s founding king. Once skeptical of his kingdom’s oil producing potential, he decided to commit to extraction. By the end of the 1930s, Saudi Arabia was the world’s largest source of crude oil.

The New Deal and World War Two helped oil recover after the Great Depression. The war also introduced the idea of a finite supply of oil, adding pressure on nations to secure supplies. In 1951, Iran kicked out western oil companies. From Suez to the first Gulf War, oil guided 20th century US foreign policy, shaping diplomacy, triggering conflict and testing the mettle of investors.

In 1973, the Arab-Israeli war led to a boycott by the Arab countries of the US, as well as the UK and other western nations who supported Israel. The “first oil shock” set a dangerous tone for the 1970s, when oil prices soared, energy supplies were threatened and economic growth stalled in many countries.

This century has been a story of globalisation as China and India led emerging markets in a race for yet more oil. Prices boomed until 2008 and the global recession, after which they rose steadily again. But at the same time, a crisis loomed amid rapidly rising awareness of oil’s central role in the climate crisis - and the growth of renewable and alternative sources of energy.

This all came to a head this year, when the overnight slump in global oil demand caused by the coronavirus pandemic hastened and exposed deep flaws. In April, as oil storage facilities reached capacity, traders started to pay to have barrels taken off their hands. Oil prices turned negative for the first time in history.

The collapse was also the result of futures trading, whereby oil is sold according to a price predicted for the time of delivery. These contracts are traded and when some of them expired in April, traders were being paid to take them on.

Prices bounced back but remained low. In June, BP predicted that oil prices will remain low for decades as governments hasten plans to hit carbon emissions targets. But the shock of 2020 has also exposed challenges in that transition, in particular for oil exporting countries, raising the risk of yet more regional instability. Becoming addicted to oil was the easy part. Weaning a world off it will be harder.

In Iraq, for example, oil revenues account for two-thirds of the economy. Long-term strains on that model will, observers predict, have far-reaching implications for the threat of terrorism and patterns of migration. “The coronavirus oil shock is not a one-off crisis; it is a dress rehearsal for a future fast unfolding,” Amos Hochstein, former U.S. Special Envoy for International Energy Affairs, wrote in June.

Back in Titusville, Pennsylvania, meanwhile, a museum stands as a monument to Edwin Drake’s historic strike in 1859. While oil has made many people very, very rich since then, Drake himself lacked the business acumen to match his drilling instincts. He died an impoverished man 20 years after striking gold. By then, he may only have appreciated in small part what he had unleashed on the world.

As the age of oil has come to an end, the age of sustainable energy has begun. In order to combat climate change and support climate friendly investment decisions, LGT Private Banking provides full transparency of portfolio carbon footprint in their clients’ statement of assets. Also, efforts in climate actions has become a criterion in choosing external asset managers at LGT Capital Partners.