在此处更改您的语言和 LGT 位置。

私人客戶的數碼平台

登錄 LGT SmartBanking

金融中介機構的數碼平台

登錄 LGT SmartBanking Pro

解答常見問題 (FAQ)

LGT SmartBanking 幫助

解答常見問題 (FAQ)

LGT SmartBanking Pro 幫助

For investors, the health and well-being megatrends offer exciting long-term prospects, especially if they are interested in sustainable investments.

"Who wants to live forever?" Eternal life may not yet be within our reach, but for more and more people, a longer life certainly is.

Considerable progress has been made in recent decades with regard to medical treatment options and technologies. In addition, more and more sick people around the world are gaining access to these services and treatments. This has brought humanity a major step closer to the United Nations' goal of ensuring healthy lives and promoting well-being for all at all ages (Sustainable Development Goal Nr. 3).

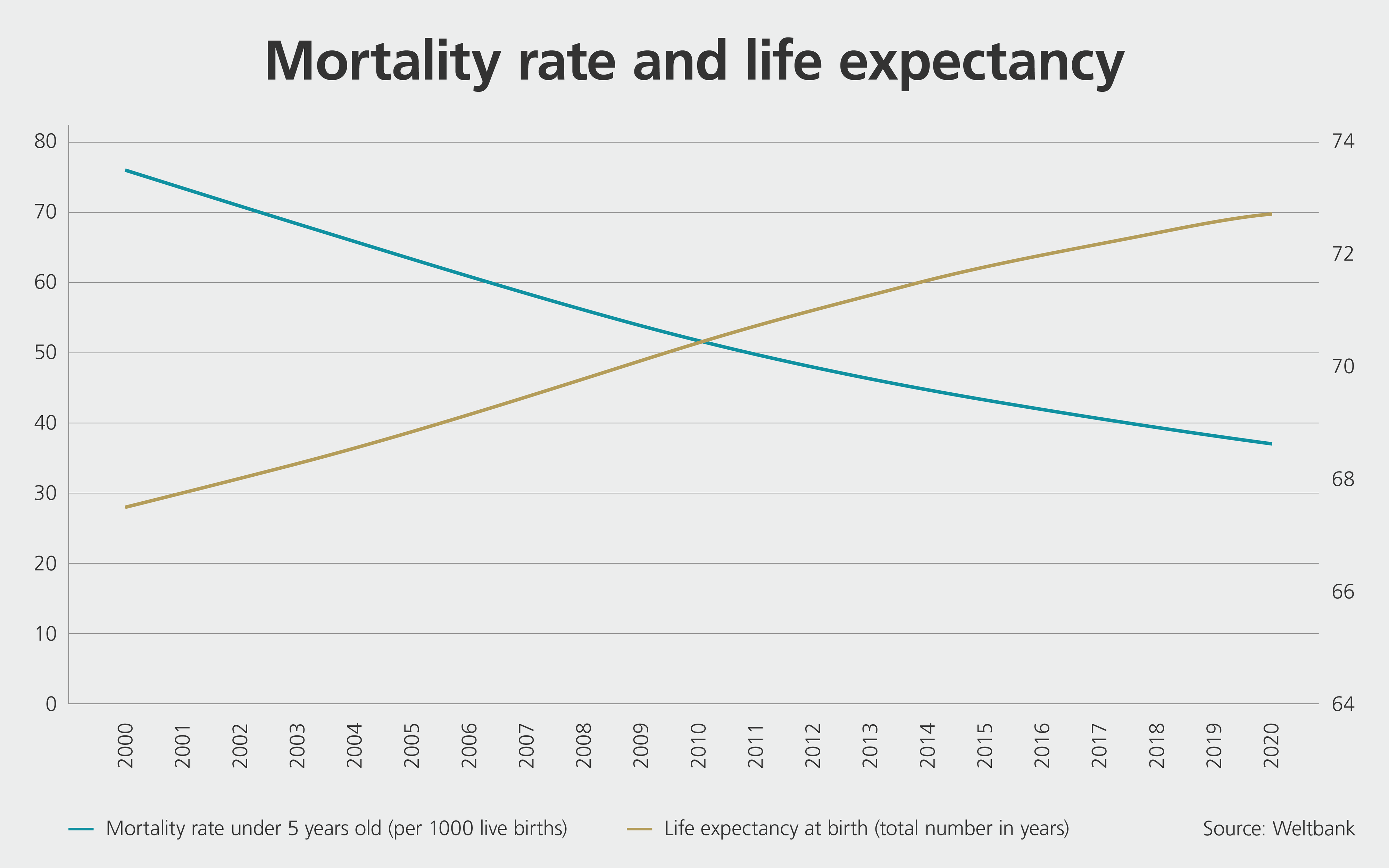

For example, between 2000 and 2019, the global mortality rate for children under five halved from 76 to 38 cases per 1000 children. At the same time, the average life expectancy of newborns has risen from just under 68 years to almost 73 years over the same period.

So is all well in the global health sector? Yes and no - despite many far-reaching improvements and successes, the number of preventable deaths remains staggering. Mortality rates may have halved from 2000 to 2019, but the numbers remain alarmingly high: in 2019, more than 5 million children died before their fifth birthday, and UN targets to combat tuberculosis, the leading cause of death from a single infectious agent in 2019, were missed by a wide margin.

At the same time, the Covid-19 pandemic has relentlessly exposed the weaknesses of current healthcare systems and inequitable access to such systems, threatening to reverse many gains that have been made.

According to a WHO study, the pandemic has stalled or even reversed progress made in reproductive and maternal health, as well as medical care for premature infants, babies, children and adolescents. Approximately 90% of participating countries still report one or more disruptions to key parts of their healthcare system - for example, sick people not receiving their medication due to supply shortages.

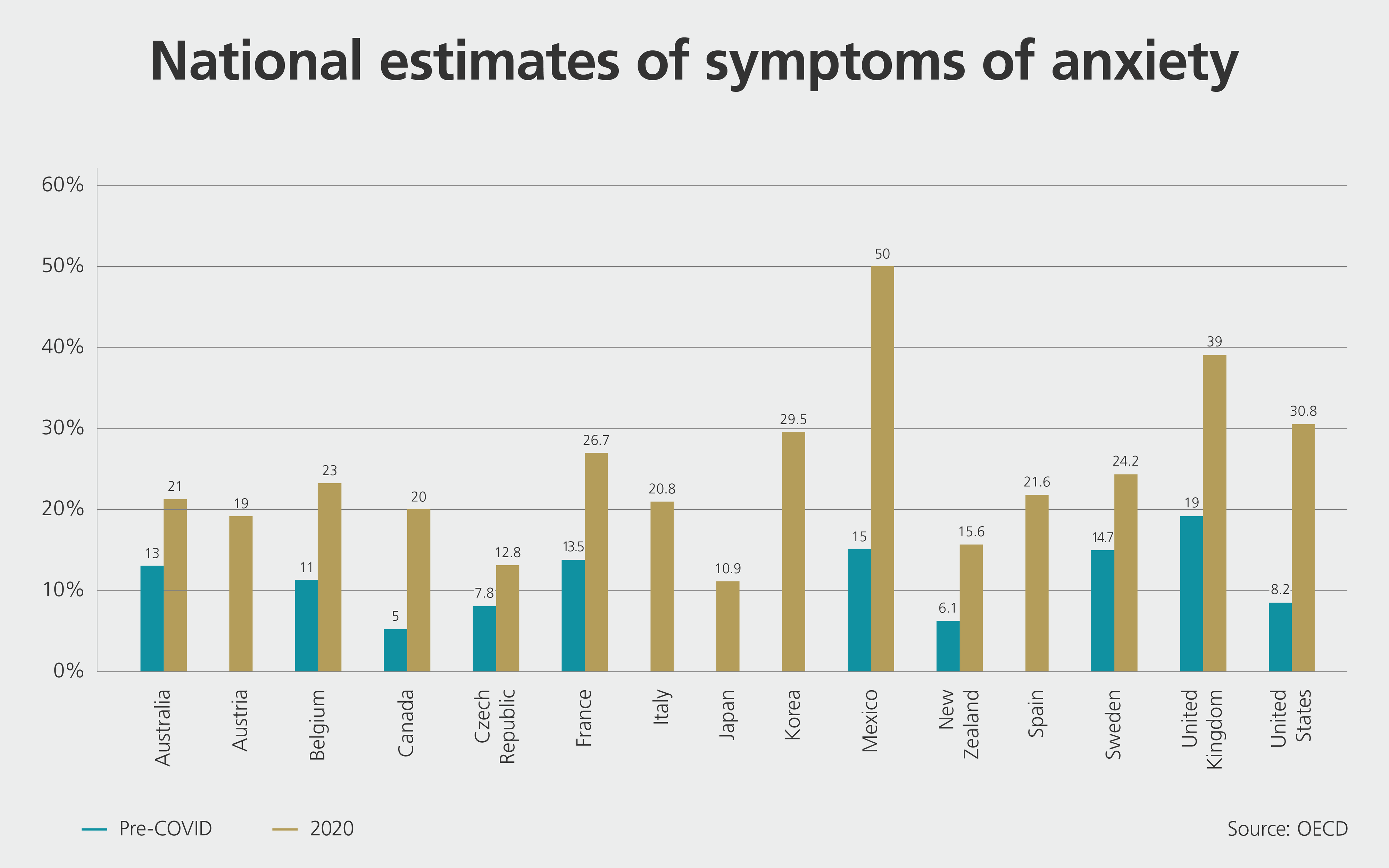

Indirect consequences of the pandemic can also be felt, with an estimated 1.4 million fewer people receiving the treatment they need for tuberculosis in 2020 compared to 2019 - especially in India and Africa. But developed countries are also experiencing significant repercussions, such as sharp increases in suicide attempts and a greater prevalence of anxiety and depression.

In addition to the acute, pandemic-related problems that exist in healthcare systems, the health and well-being industry is also facing a structural transformation that will give rise to far-reaching changes in the medium to long term:

For investors, these upheavals translate into attractive opportunities: with the right investments, they can benefit from global megatrends and at the same time create value for society - namely through the further development of medical solutions and access to medicine for all.

In 2021, the Swedish project "EIT Health" received the social bond of the year award, reflecting the current attractiveness of investments in the area of prevention.

As part of a private issue by the insurer Skandia, 21 000 people with an increased risk of diabetes will receive financial support for diabetes prevention. In the event of illness, part of the costs will be covered. However, if it turns out that the patient has been able to reduce the likelihood of becoming diabetic as a result of the program, the local government pays Skandia up to 10% on the investment.

Overall, the Stockholm government saves money by having fewer diabetes patients - a return on investment of up to 100% is expected - and Skandia receives additional premiums if it helps at-risk patients through preventative measures.

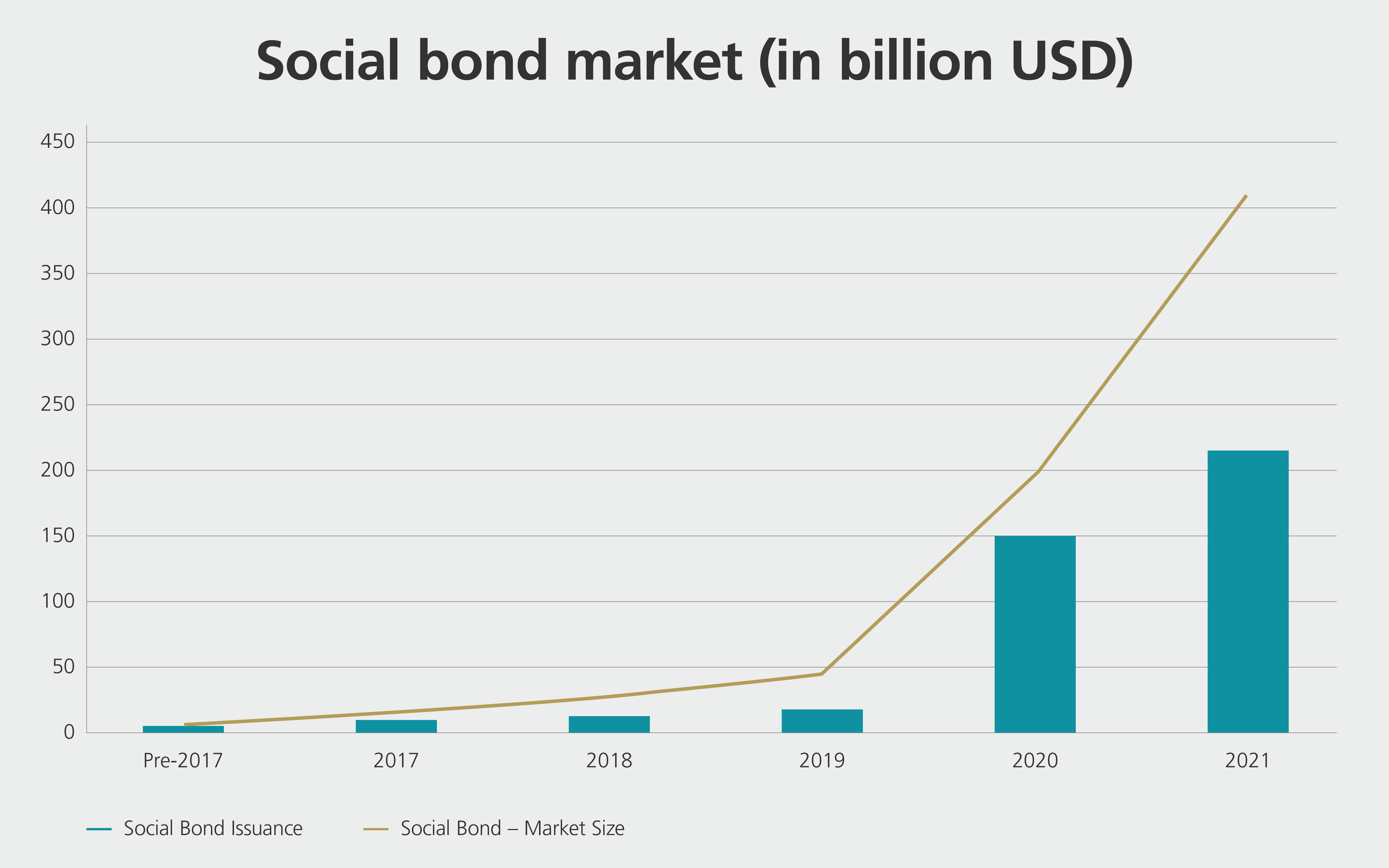

The pandemic is making social bonds even more attractive: after the first social bond issues in 2016 and 2017, the Covid-19 pandemic led to a surge in issues in 2020. At approximately 150 billion US dollars, the volume of such bonds has increased nearly tenfold year on year. Over time, the social bond market is therefore evolving from a small niche market to an established sub-asset class.

Title image: © GettyImages, Tom Werner / GettyImages, Morsa Images / GettyImages, Marko Geber

Despite global progress in the health sector, the number of preventable deaths remains high. In addition, the Covid-19 pandemic is threatening to reverse many gains that have been made.

Global trends such as an increasingly ageing and wealthier world population and the associated healthier lifestyles are bringing about structural change in the health and wellbeing sector.

This structural change offers opportunities for investors.