在此处更改您的语言和 LGT 位置。

私人客戶的數碼平台

登錄 LGT SmartBanking

金融中介機構的數碼平台

登錄 LGT SmartBanking Pro

解答常見問題 (FAQ)

LGT SmartBanking 幫助

解答常見問題 (FAQ)

LGT SmartBanking Pro 幫助

Tariffs have evolved over time from being a way to fund governments to an instrument of geopolitical power. Understanding their impact is key to navigating today's investment environment.

Tariffs have been in the headlines since US President Donald Trump began imposing, then modifying, heavy new import duties on allies and rivals alike. His actions demonstrate how an aggressive tariff policy can have a major impact on world markets.

But while tariffs are essentially taxes on international trade, history shows that they've often been much more than that.

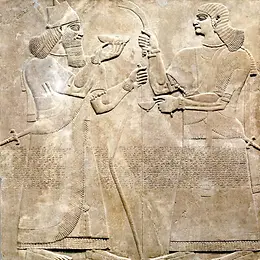

Long before income taxes filled government coffers, kings and emperors in ancient Mesopotamia, imperial China, and medieval Europe levied duties on goods crossing borders to raise revenue and control trade flows.

Tariffs served this purpose in the early days of the United States, too. Among the first laws passed by the US Congress was the Tariff Act of 1789, which established duties on imported goods to generate revenue and protect fledgling industries. Tariffs remained the USA's primary source of federal income until the introduction of income tax in 1913.

It was around 200 years ago that tariffs began to be used to protect favoured industries or people. The UK Corn Laws of 1815 are the quintessential example: duties were imposed on imported grain to support domestic agriculture. High prices and limited access to cheaper foreign grain benefited landowners and farmers, but penalized urban consumers, industrial workers, and manufacturers - because people had less money to buy their goods. The laws were only repealed in 1846 after years of opposition.

Free trade built bridges - then came the blowback

Tariffs also sowed division in the USA around this time, although here the industrialists benefited. The 1828 "Tariff of Abominations" protected manufacturers in northern US states by dramatically raising duties on industrial imports. However, this hurt agriculture in the South, where they not only paid more for factory goods, but saw cotton exports fall (trade partners' incomes had dropped). The discord expanded into issues of states' rights and slavery, and eventually led to the US Civil War.

Later, after the Great Depression of 1929, Congress passed the Smoot-Hawley Tariff Act of 1930. This raised duties on hundreds of imports in an attempt to protect US jobs. But not only was this ineffective, it sparked a global trade war as countries retaliated by imposing tariffs on US exports.

"Back then, the economic rationale for tariffs was rooted in a need for immediate, visible relief for struggling sectors - even if the longer-term global repercussions, such as retaliatory measures and declining international trade, were not fully appreciated," says Tina Jessop, Senior Economist at LGT Private Banking.

Following this policy failure Congress introduced the Reciprocal Trade Agreements Act of 1934, allowing the president to negotiate bilateral tariff reductions, and ushering in a more flexible, diplomacy-driven trade policy.

Tariff policy shifted decisively toward liberalization after World War II. The Bretton Woods Agreement of 1944 and the General Agreement on Tariffs and Trade (GATT) signed in Geneva in 1947, aimed to reduce trade barriers, foster economic interdependence, and avoid the political isolationism of the 1930s.

Tariffs were still used to protect certain industries and even individual companies. For example, US motorcycle manufacturer Harley-Davidson faced fierce competition from Japanese motorcycles in the 1980s. When President Reagan imposed temporary tariffs on these, it gave Harley-Davidson time to restructure its manufacturing practices.

But overall, tariff cuts accelerated. The EU Single Market launched on January 1, 1993. The North American Free Trade Agreement (NAFTA) between the USA, Mexico and Canada came into effect in 1994 (it was renegotiated and ratified as the USMCA in 2020). The World Trade Organization (WTO) opened its doors in 1995.

While lower tariffs helped to fuel global economic growth, NAFTA led to a loss of US manufacturing jobs to Mexico. And after China entered the WTO in 2001, and many countries reduced tariffs on Chinese products, there was a surge of manufactured goods from China. While good for western consumers, this "China Shock" hurt many industries and led to large job losses in numerous countries. Understandably, this caused "lingering resentment from people who saw their communities hollowed out by the deindustrialization," as Andrew Cohen, professor of American history at Syracuse University points out.

The result? A rise in economic nationalism - and populism.

Tariffs have now reemerged not just as a way to fund governments (tariff revenues helped the US maintain its "AA+" credit rating by S&P in August 2025) or as economic tools to protect national industries (in 2024 the EU imposed finely targeted new anti-subsidy tariffs on Chinese electric vehicle imports), but increasingly as instruments of geopolitical power.

In the USA, while the Constitution gives Congress authority to set tariffs, Congress has delegated some of this power to the executive branch to use at times of national emergency, threats to the US economy, or for national security. This is how, by declaring national emergencies related to trade deficits, manufacturing decline, and synthetic opioids, President Trump has been able to use executive orders to bypass Congress and impose his sweeping - and often unpredictable - tariffs.

"While the role of tariffs has evolved over time, they remain a powerful tool in the policymaker's arsenal. Though tariffs can provide relief or leverage when needed, their broader economic and political consequences require thoughtful consideration," says Jessop.

"Unlike in 1930, when the world's economies were far more insular, today's global supply chains mean the economic impact of tariffs is more complex".